TABLE OF CONTENTS

- Reports – track your business performance

- Types of reports

- Search criteria and filters

- Sales and bookings reports

- Accounting and payment reports

- Brokerage sales report

- Statistics and KPI reports

- Bookings export report

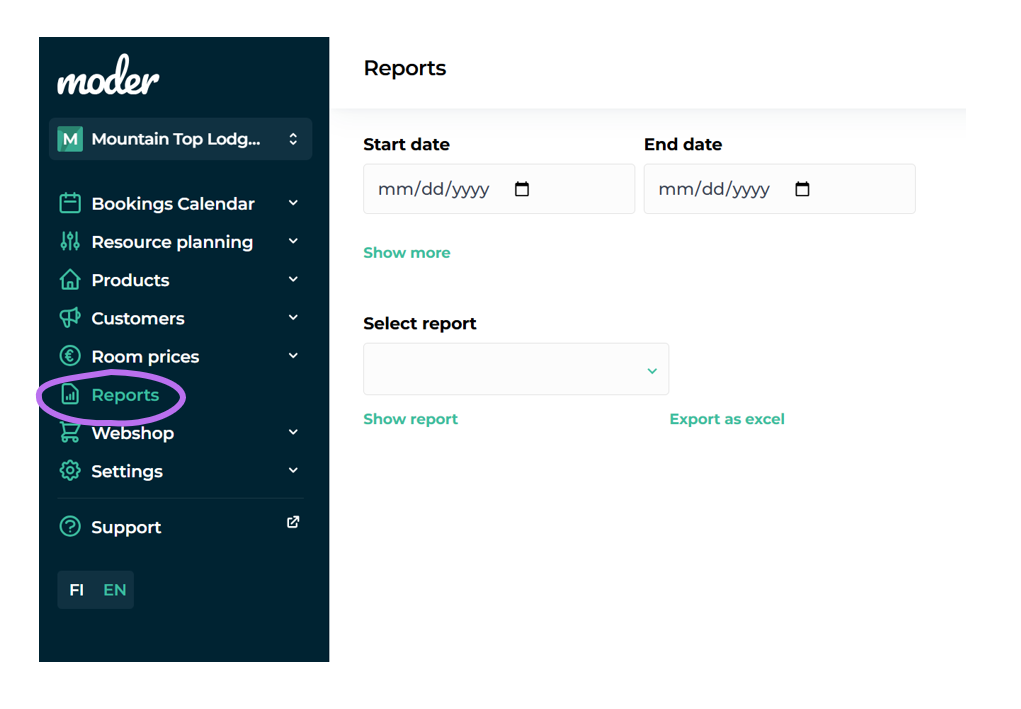

Reports – track your business performance

The Reports tab allows you to monitor your business performance through numbers and access the necessary reports for your accountant. With reports, you can review bookings, sales, statistics, and other key metrics that help you manage and optimize your business operations.

Reports provide comprehensive tools for tracking, analyzing, and supporting decision-making for your business.

You can find Moder’s reports in the menu on the left-hand side.

Types of reports

The Reports tab offers a variety of reports tailored to different needs:

Bookings

- Settled bookings: Displays all bookings completed during the selected period. This report provides an overview of bookings that concluded during the specified time frame.

- Bookings: Shows all bookings that began within the selected period. This report helps track which bookings commenced during the given period.

Payments and accounting

- Orders/Invoices: Examines orders and invoices along with their payment statuses, aiding in payment flow management and monitoring.

- Open receivables: Displays all unpaid invoices and receivables, keeping you updated on the company's outstanding payments.

- Advance sales report: Tracks prepayments and their statuses, assisting in monitoring payments related to future bookings.

- Daily payment report: Provides a daily view of payment transactions by payment methods, such as cash, card payments, and online payments.

- Sales report by bookings: Lists all bookings created during the selected period and helps monitor booking volumes and sales trends over time.

- Sales sorted by tax: Breaks down sales by VAT rates.

- Sales for accounting: The ideal report for accounting purposes, including sales, prepayments, and unpaid invoices on a monthly or selected timeframe basis.

- Deposit ledger: The best report for tracking prepayments that have not yet been accounted as sales revenue.

Brokerage sales

- *Brokerage sales report: shows the amount to be paid out to the unit owners (NOTE: this report is only applicable if you are using brokerage sales feature in Moder)

Statistics and analytics

- Statistics: Compiles key statistical data, such as occupancy rates and other business metrics, to help assess operational efficiency.

- KPI: Displays essential business metrics like occupancy rate, average daily rate (ADR), and revenue per available room (RevPAR).

Integration with other systems

- Bookings export: Allows you to export bookings to Excel or other systems like MailChimp, making data processing and marketing easier.

Search criteria and filters

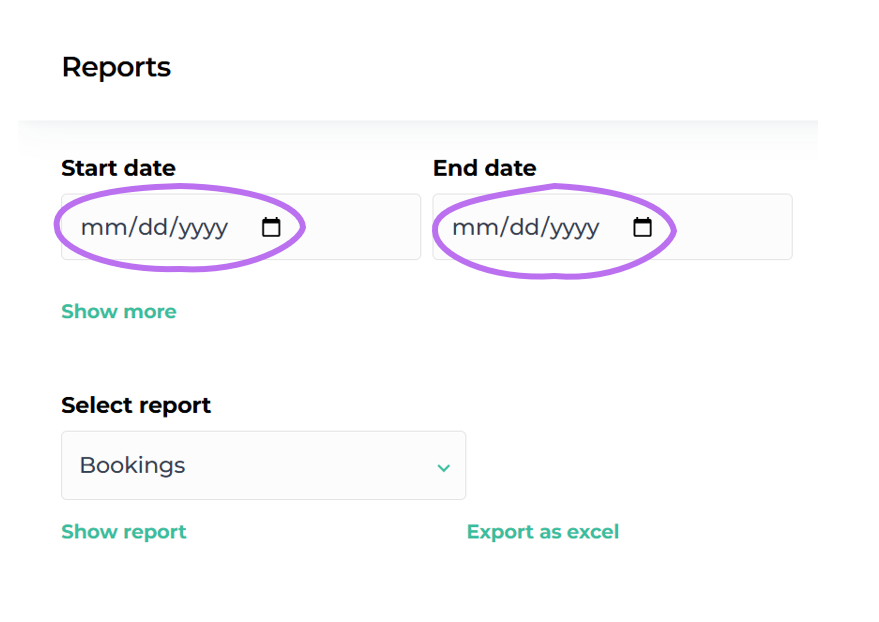

When viewing reports, you can set search criteria to customize the report content to suit your needs:

Select the time period

First, define the time range you want to analyze. This helps you focus on a specific period, such as a month, quarter, or full year.

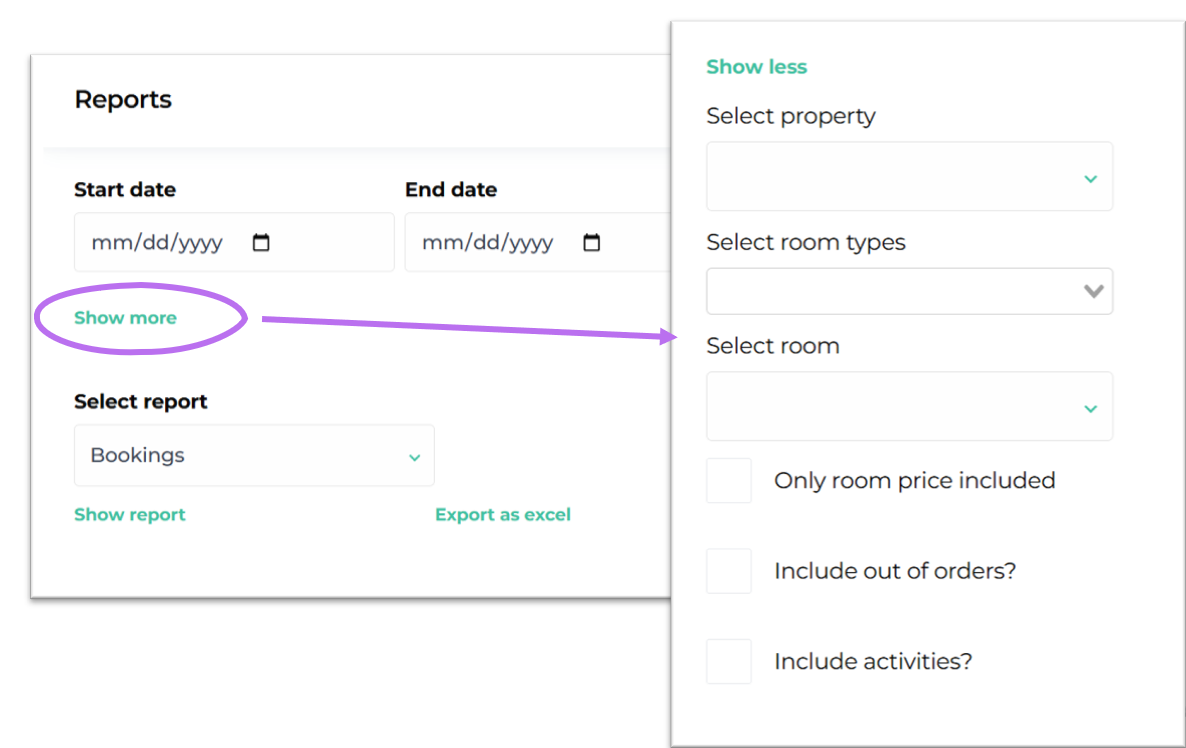

Show more search criteria

By clicking the "Show more" button, additional filtering options will appear.

You can refine the report based on specific criteria, such as property, room type, or individual rooms. This is useful when you want to analyze data for particular items in greater detail.

Filter report content

You can choose to focus solely on accommodation revenue and exclude any additional services from the report. This provides a clearer view of revenue generated specifically from accommodation.

Out of order items can also be included in the report if desired. Depending on the report type, these may appear as bookings or changes in occupancy rates.

You can also include activities in the reports, giving you a detailed overview of activity sales if they are part of your product offering.

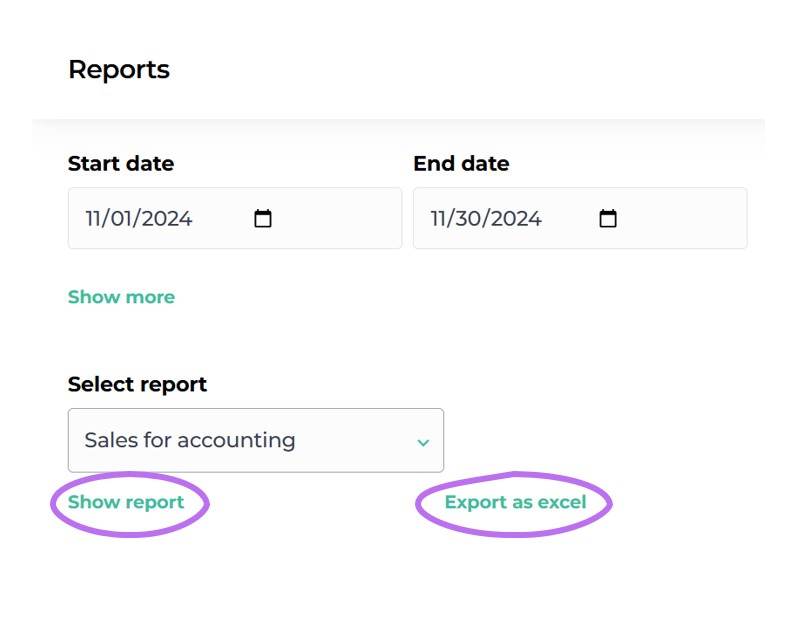

Select a report

From the drop down menu, choose the report you want to view.

Excel or PDF

Click the "View report" button to open the report in PDF format in a new tab.

All reports can also be exported directly to Excel by clicking the "Export to Excel" button. This allows for further processing and analysis according to your needs.

Sales and bookings reports

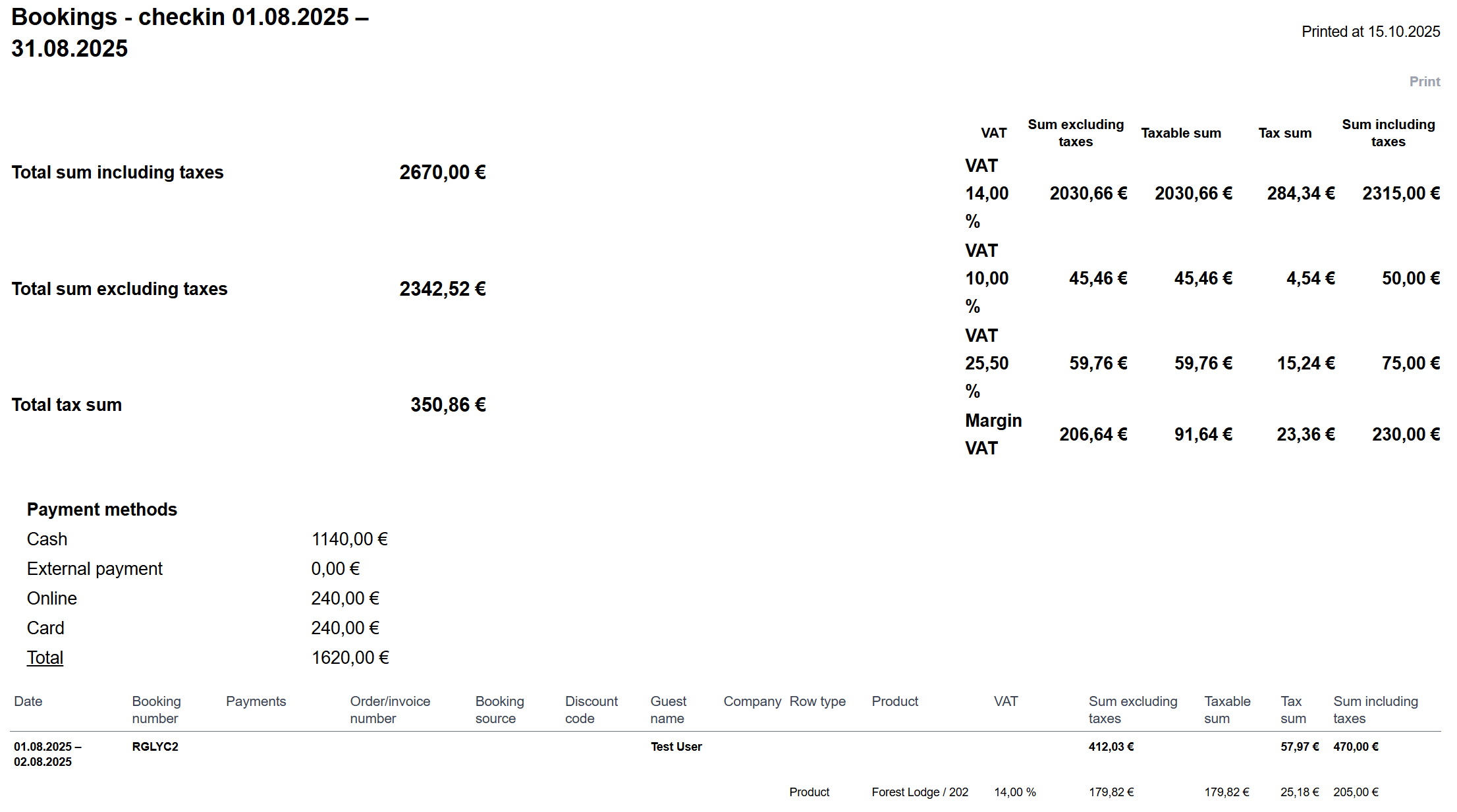

Bookings - check-in

This Bookings - check-in report provides a comprehensive overview of all bookings that began during the specified time period.

This report is a valuable tool for business monitoring, as it helps you examine where bookings originate, how payment methods are distributed, and the taxes associated with each booking. It offers critical insights that allow you to analyze sales trends, track the origins of bookings, and better understand your business performance across various channels.

Key details of the report

Booking source:

- Webshop: Bookings made directly through your company's webshop.

- Back-end system: Bookings created manually in Moder's booking calendar, typically by staff.

- External sales channel: Bookings made via third-party platforms such as Booking.com or similar channels.

- Destination: Displays bookings from cross-selling with another Moder platform, useful if your properties are listed across multiple destinations.

- Tax breakdown:

- Shows detailed tax information related to bookings. This breakdown is essential for financial management and accounting, as it provides specific details about the taxes associated with each booking. It also helps assess the impact of taxation on different bookings and sales channels.

- Payment method breakdown:

- Lists payment methods, such as online payments processed through Paytrail or Stripe, separately.

NOTE: This report does not include canceled bookings.

This report effectively tracks booking origins, payments, and taxes, making it a valuable asset for business analysis and management.

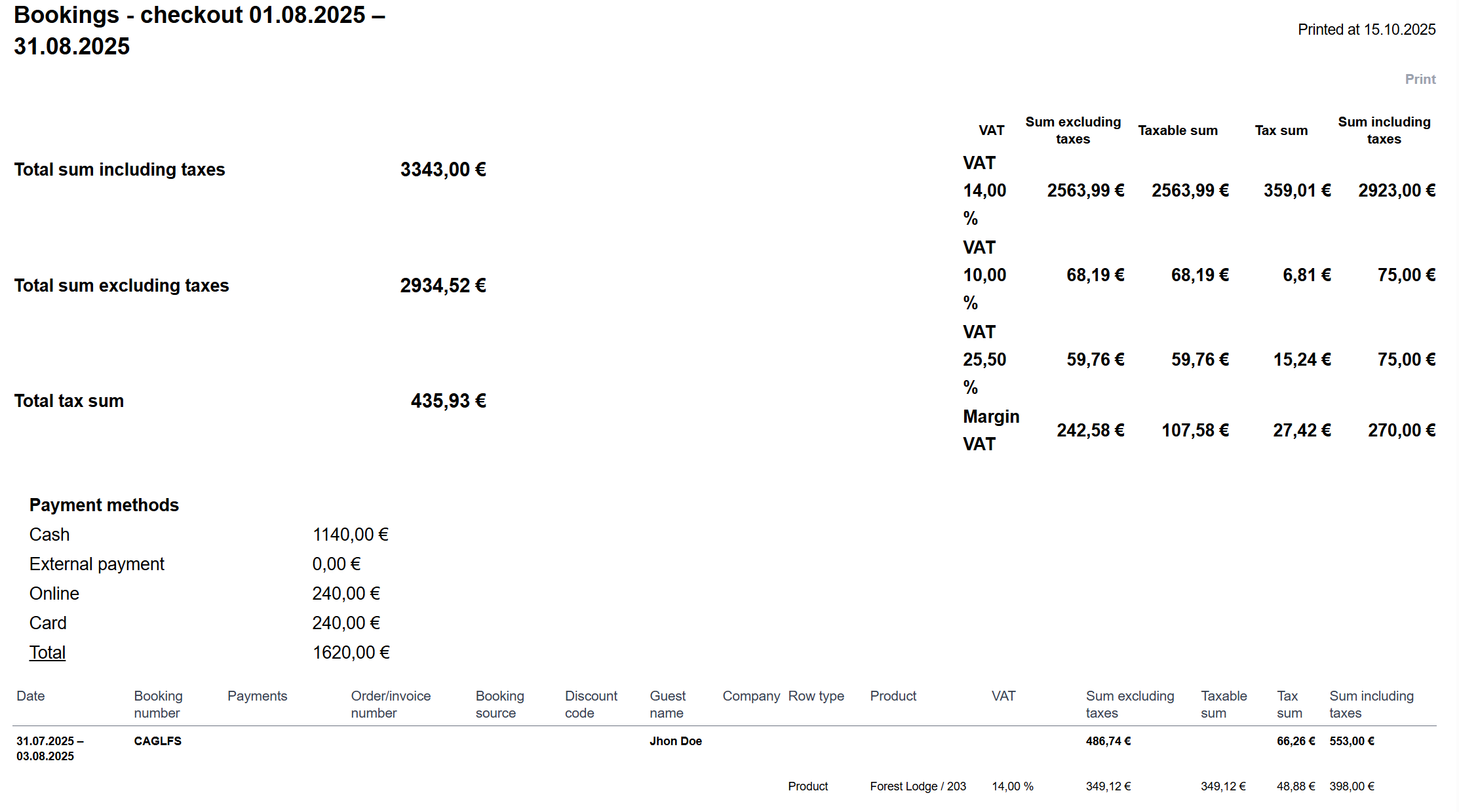

Bookings - check-out

This report is designed to list all bookings that ended during the selected time period.

It is particularly useful for accounting purposes, as it provides a view of bookings that should no longer have any changes in sales or duration since all bookings in this report have already ended. This often makes it a better option for accounting compared to the Bookings - check-in report.

Key details of the report

Booking source:

- Webshop

- Back-end system

- External sales channel

- Destination (if properties are cross-sold with another Moder platform)

- Tax breakdown:

- Provides detailed information on the taxes associated with bookings.

- Payment method breakdown:

- Includes details on payments, such as online payments made via Paytrail or Stripe.

Important notes

- If the "Total sum including taxes" and "Payment methods total" amounts do not match, this indicates that there are bookings in the report that have either not been marked as paid or have overpayments (payment entries exceeding the booking amount). In such cases, check the payment entries for completed bookings in the selected time period.

- Canceled bookings are not included in the report.

Purpose of the report

This report provides reliable data to support accounting and financial reporting, especially when reviewing completed bookings whose details should no longer be modified.

It is particularly valuable for accounting as it focuses solely on completed bookings, making it a dependable source for financial analysis and reporting. The breakdowns of booking sources, taxes, and payment methods offer a clear overview of bookings and help identify potential discrepancies in payment entries.

The exclusion of canceled bookings ensures that the report focuses only on relevant data.

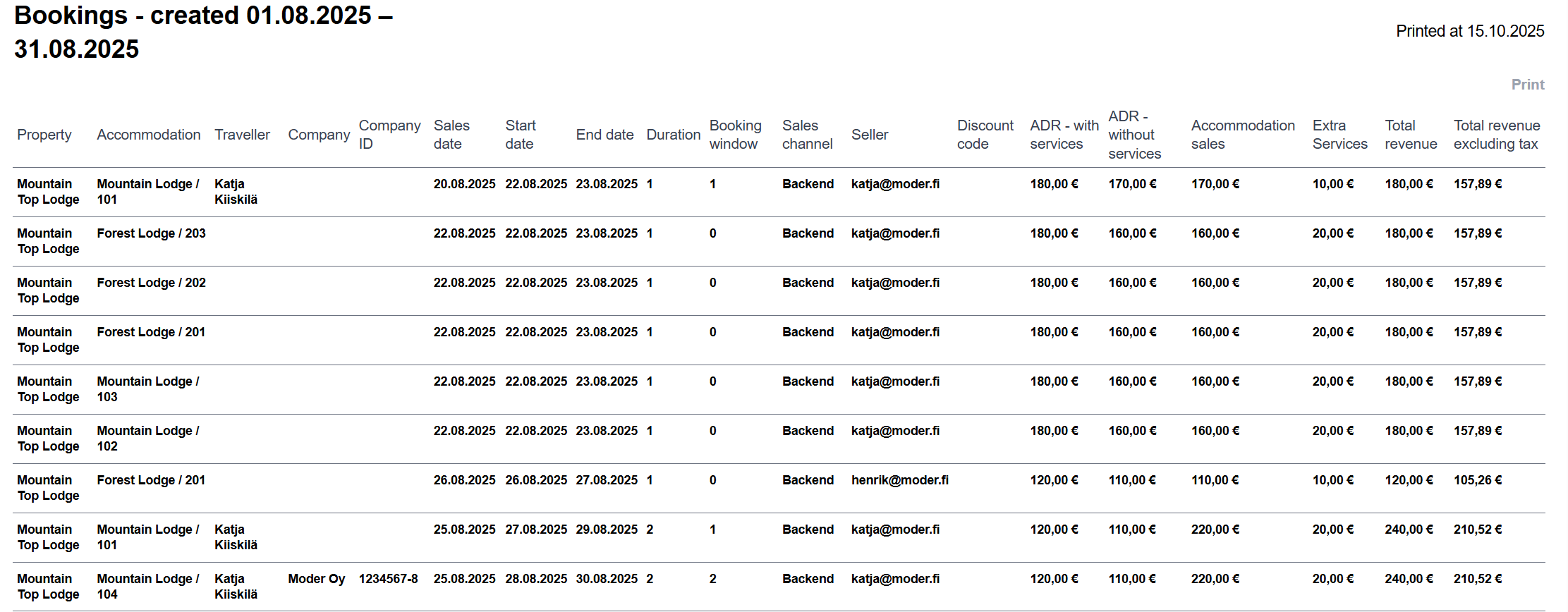

Bookings - created

The Bookings - created report provides a detailed overview of all bookings created within the selected time period.

This report is a valuable tool for monitoring and analyzing accommodation business performance, especially regarding sales channels and employee contributions.

Key details of the report

- Booking period:

- The report includes all bookings created during the selected time range.

- Booking channels and employees:

- The report displays the channel through which each booking was made (e.g., webshop, external sales channel). If the booking was created directly in Moder's booking calendar (back-end), the report also shows the name of the employee who created the booking.

- Discount codes:

- If a discount code was applied to a booking, it will be displayed in the report. This allows you to track the impact of discounts and promotional campaigns.

Use cases of the report

- Use the report to review and track new bookings, as well as to evaluate the productivity of marketing campaigns.

- For best results, export the report to Excel for further sorting, analysis, and visualization.

- This report is an essential tool for measuring the impact of sales and marketing efforts, helping businesses understand which channels and campaigns deliver the best results.

Accounting and payment reports

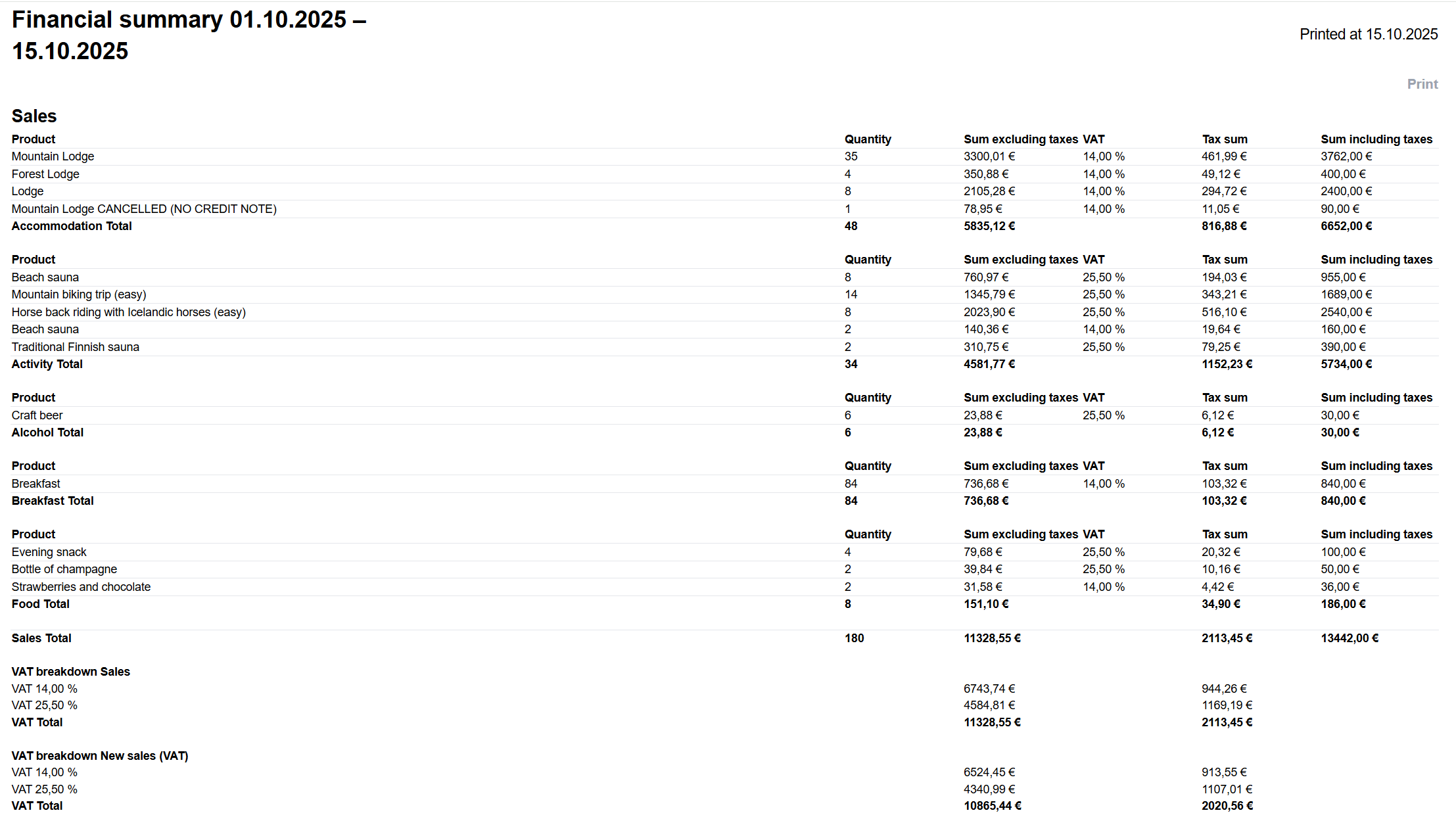

Financial summary

This report is specifically designed to meet the needs of accounting and provides a comprehensive overview of sales on a monthly basis. It is an ideal tool for reviewing materials for accounting, offering detailed breakdowns of sales, deposits, and outstanding invoices.

Key details of the report

- Sales during the period:

- Displays all sales within the selected period, including sold products and services.

- Prepayments (deposits):

- Shows reservations prepaid during the selected period.

- Realized prepayments:

- Includes prepayments converted into sales, such as completed stays or utilized services. This section functions as a "guest ledger."

- Payments during the period:

- Lists all payments made within the period, categorized by payment method.

- Outstanding invoices:

- Displays all unpaid invoices and their VAT breakdowns.

- VAT breakdown:

- Details VAT for sales, prepayments, and realized prepayments.

- Details VAT for sales, prepayments, and realized prepayments.

Important notes

- The report may contain large amounts of data, so downloading it might take time.

- The report can be filtered by location, but no other filters are available.

- Sales for reservations spanning multiple months are evenly distributed across those months.

Extra services on the report:

- Per-night services: Services like breakfast are allocated nightly for each guest.

- Extra charge services: For example, pet fees are assigned to the check-in date (the first night).

Canceled bookings:

- Unpaid reservation: The reservation is removed from the report entirely.

- Paid reservation without a credit note: The reservation remains on the report with a "NO CREDIT NOTE" label, and the payment is listed under deposits and realized prepayments.

- Paid reservation with a credit note: The reservation and deposit are removed from the report, and the credit note is recorded under payment methods.

Financial summary report sections explained:

Sales

Displays the sales that occurred during the selected period, including products and services. The report categorizes the sold products for better clarity. If you see "Property Account" at the bottom of the categories, it refers to invoices created without an associated reservation.

The sales section also includes canceled reservations for which a credit note has not been issued. These canceled reservations are marked with the label (NO CREDIT NOTE), indicating that no credit note has been created.

Below the sales section, you will find a VAT breakdown for the period's sales and new sales.

- The upper VAT breakdown reflects the total sales for the period.

- The lower VAT breakdown covers new sales that have not yet been recorded as prepayments.

Deposit removals

Realized prepayments refer to completed stays or utilized services. This section also includes a VAT breakdown specifically for the realized prepayments.

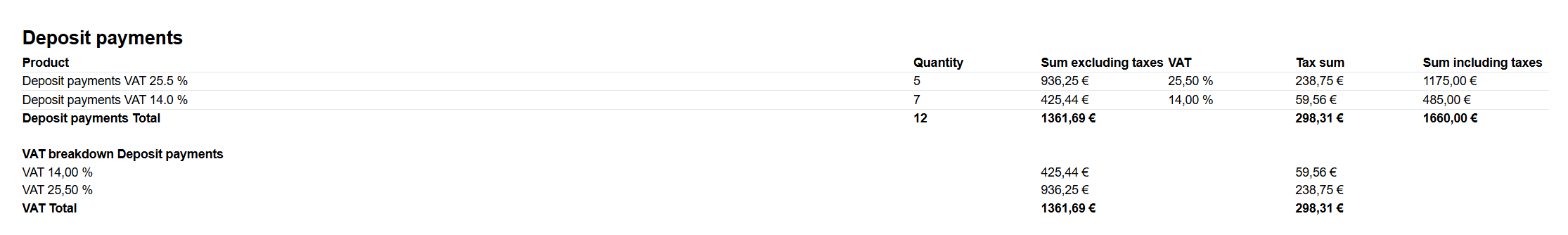

Deposit payments

Lists all prepaid reservations along with their VAT breakdown for the selected period.

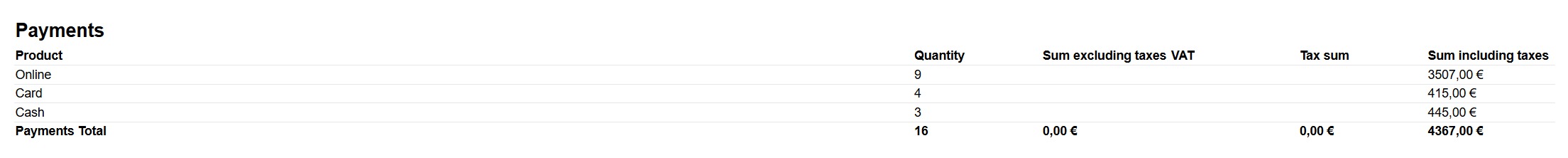

Payments

Includes all payments that were taken during the selected period.

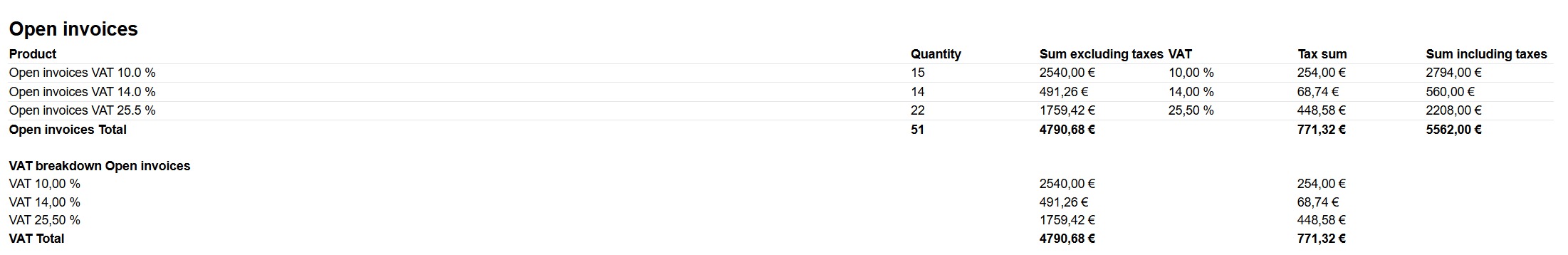

Open invoices

Displays all open and unpaid invoices along with their VAT breakdown. These are invoices created during the selected period. If you wish to view additional open invoices, refer to the Open Receivables report.

This report is an essential tool for managing accounting, as it provides precise details on sales, prepayments, open invoices, and VAT. It ensures that all accounting-relevant transactions are accurately recorded and properly categorized.

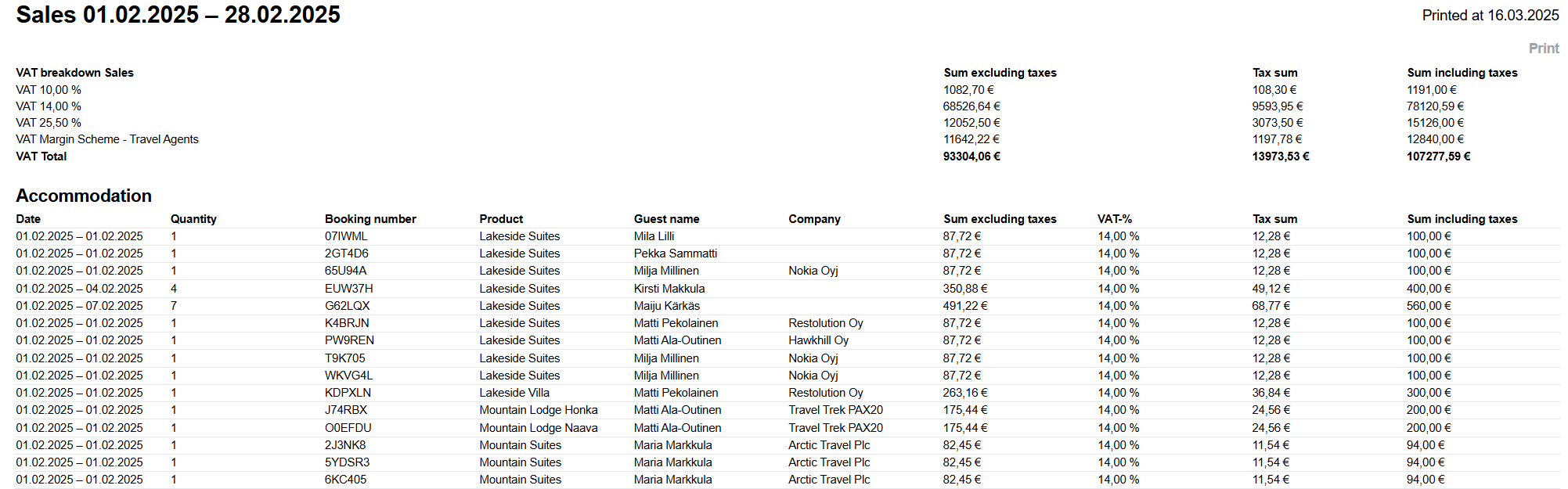

Sales

The sales report lists all sales during the reporting period on a daily basis.

What the report shows

- Total sales, broken down by VAT

- Sales by product category and the reservations that generated the sales

- Reservation details: date, sales quantity, and reservation number

- Booker details: traveler and company information

How the report works

The report functions in the same way as the Financial summary:

- Reservations: Reservations are split into daily sales. If a reservation spans across reporting periods, the sales are divided by day and allocated to the respective periods.

- Extra services

- Per-night services: Per-night extra services (e.g., breakfast included in the price and automatically calculated for each day and each guest) are divided into nightly sales.

- Other extra services: Extra services for an additional charge (e.g., pet fee) are recorded on the check-in date, i.e., the first night.

- Canceled reservations

- If a reservation is canceled and has not been paid (no prepayment) → it does not appear on the report.

- If a reservation is canceled and paid, but no credit note has been issued (prepayment received) → the reservation remains on the report, but is marked as canceled without a credit note (NO CREDIT NOTE). In this case, the payment also appears under both prepayments and prepayment reversals.

- If a reservation is canceled and a credit note has been issued → the reservation is removed from sales and prepayments → the credit note is recorded under payment methods.

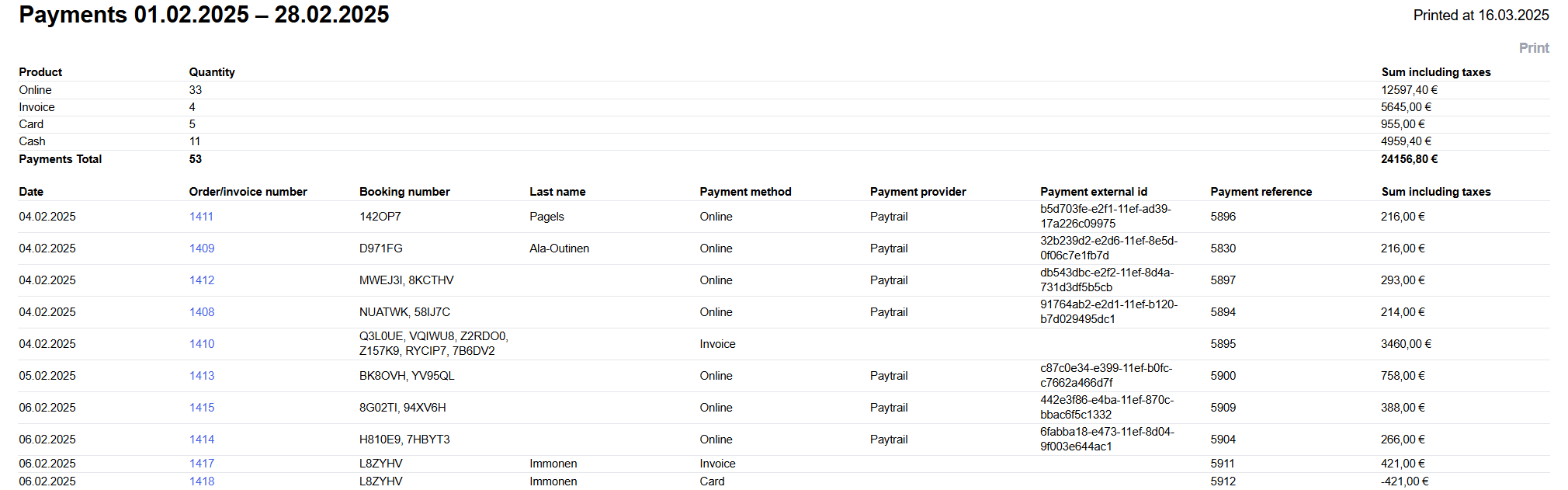

Payments

The payments report shows all payments during the reporting period. The data matches the Financial summary report. With this report, you can verify payment allocations and investigate possible error situations.

What the report shows

Total payment amounts: All payments by payment method, by quantity, and the total sum of payments

Payment transactions: A chronological list of payment transactions

Payment allocation: Which invoices the payments are allocated to. The report includes a link to open the invoice directly for review.

Reservations: Which reservations the payments are allocated to

Payment method: The method used for the payment

Payment provider: Paytrail or Stripe, if the payment was made through the POS or webshop

Payment provider ID: A unique ID provided by the payment provider (Stripe or Paytrail) for reconciliation purposes

Payment reference: The payment reference that Moder passes on to the payment service provider (Stripe or Paytrail)

Total payment amount

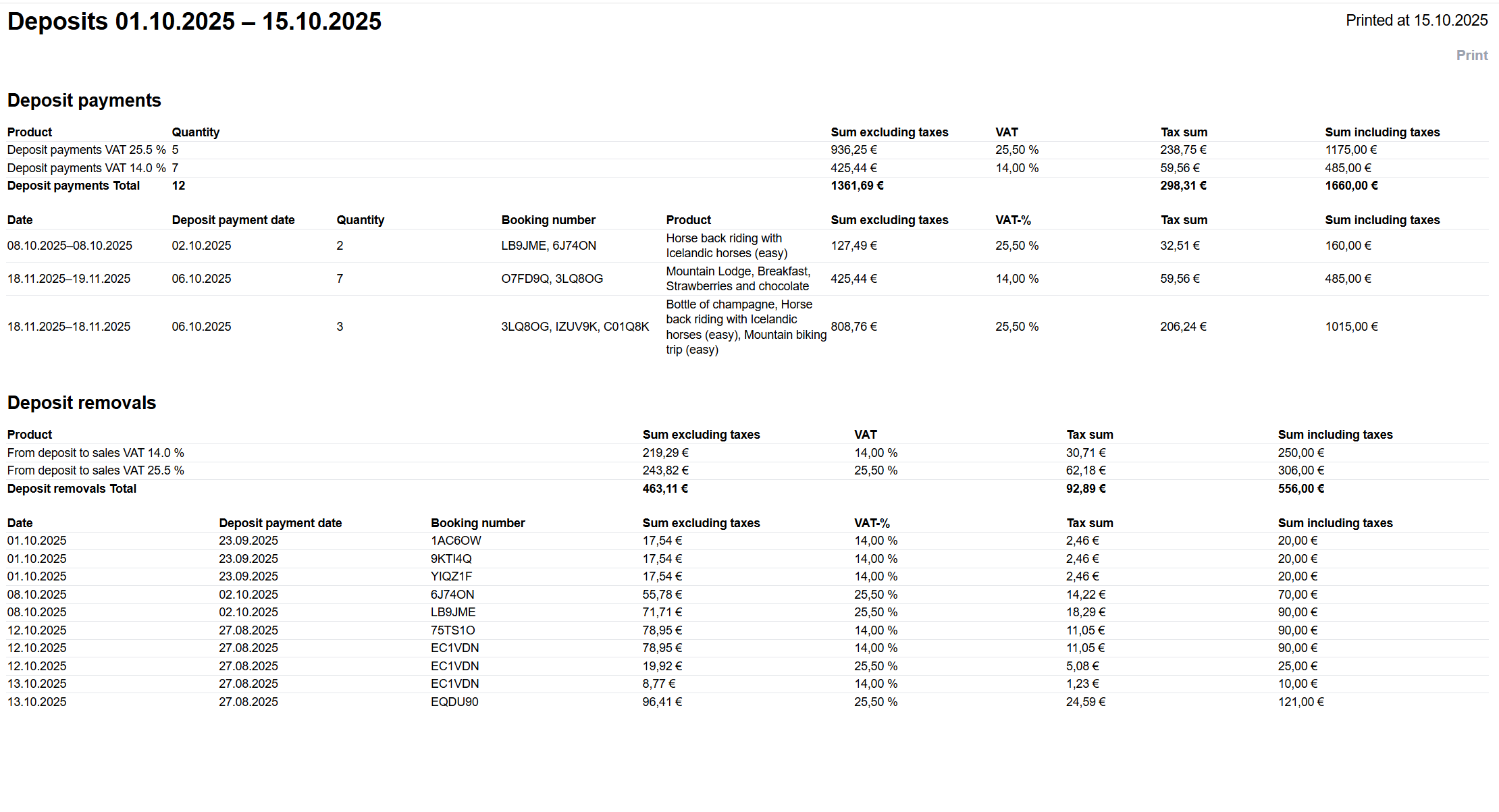

Deposits

The deposits report shows new deposits and released deposits during the reporting period. The report summarizes the status of deposits on a daily basis.

What the report shows

Total amount of new deposits by VAT rate

New deposits: Line-level details of how the new deposits were formed

Total amount of released deposits by VAT rate

Released deposits: Line-level details of released deposits by reservation

Reservations: Which reservations the deposit changes are linked to

Deposit payments

Lists all deposit payments during the reporting period. Deposits are all reservations where the payment occurred before the reservation start date. For example, a webshop booking paid in advance, or a back-office booking where an invoice and payment record were created before the reservation began.

Deposit removals

This section lists reservations that were paid in advance and where the reservation has taken place (the product was delivered to the customer) during the reporting period.

Invoice list

Invoice list report provides a detailed overview of all invoices and orders within a selected time period.

This report is an essential tool for financial management as it offers an accurate view of the company's billing and order situation, as well as the status of payments. It allows you to track the progress of invoices and orders, manage cash flow, and ensure all financial transactions are up to date.

Key details of the report

- Invoices:

- All sent PDF invoices: The report includes all invoices sent to customers. Invoice details help track when invoices were sent and ensure they are properly scheduled.

- Invoice date determines report appearance: The date on the invoice, not the due date, determines when it appears in the report. For example, an invoice dated 25 September with a due date of 5 October will appear in the September report. This ensures a clear timeline in invoicing.

- Orders:

- Webshop orders: The report includes all bookings from the webshop that have been paid via Stripe. These details provide precise insights into webshop sales and help monitor revenue generated directly through the webshop.

- Payment status:

- Status indicators: The report shows the payment status of invoices, such as the amount paid and the outstanding balance. This information is crucial for financial management and payment tracking, helping to identify which invoices have been paid and which remain open. It also helps monitor payment delays or unpaid invoices, critical for cash flow management.

Note! If a booking is canceled but still has an associated invoice or payment received via Stripe, these invoices and payments will appear in the report. This ensures all financial transactions, including those related to canceled bookings, are properly recorded and tracked.

Purpose of the report

The report is a vital tool for tracking invoices and orders, supporting financial management by providing a clear overview of all open and paid invoices as well as webshop orders.

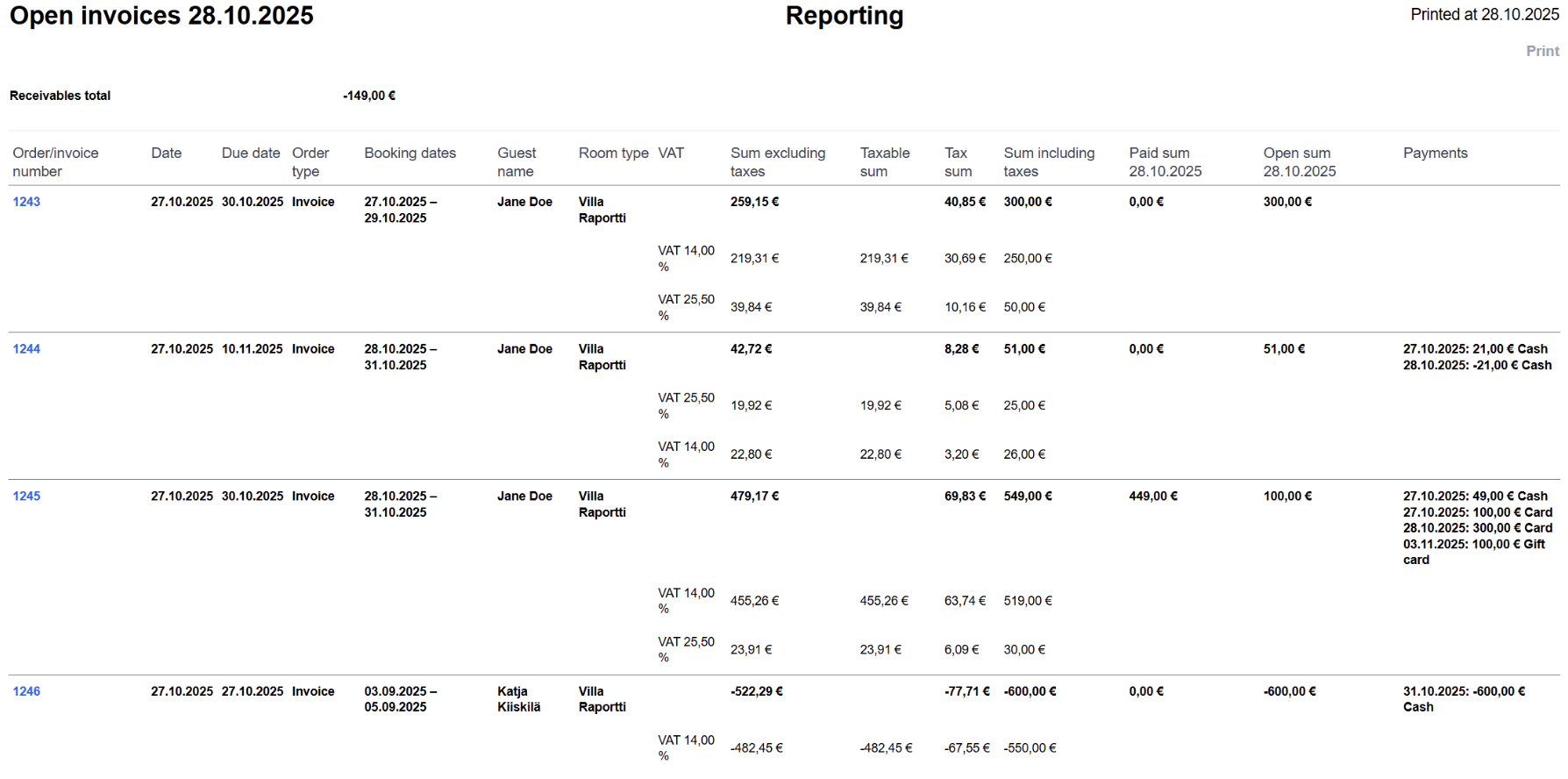

Open invoices

Open invoices report provides an up-to-date view of all outstanding invoices and receivables.

The Open Invoices report shows the status of open invoices as of the selected end date — regardless of when the report is generated. The start date must be selected, but it has no effect, as the report displays open receivables according to the chosen end date.

For example, when reviewing open invoices as of September 30, 2025, the report will show the same information on October 1, 2025, or even January 1, 2026, even if the invoices have been paid later:

The Open Amount and Paid Amount columns include date information, and the invoice numbers are links that take you directly to the respective invoices.

Key details of the report

Report period:

- The report displays invoices that are outstanding or were paid after the selected end date.

- Start date: While a start date is required for generating the report, its role is minimal, as the focus is on invoices that remain outstanding on the selected end date.

- Outstanding receivables:

- The report compiles all invoices that are still open receivables as of the end date. This includes invoices that have not yet been paid or were paid after the selected date.

Purpose of the report

- The report helps businesses monitor sales receivables and ensure all outstanding invoices are up to date.

- It is a critical tool for financial management, particularly for payment monitoring and cash flow management.

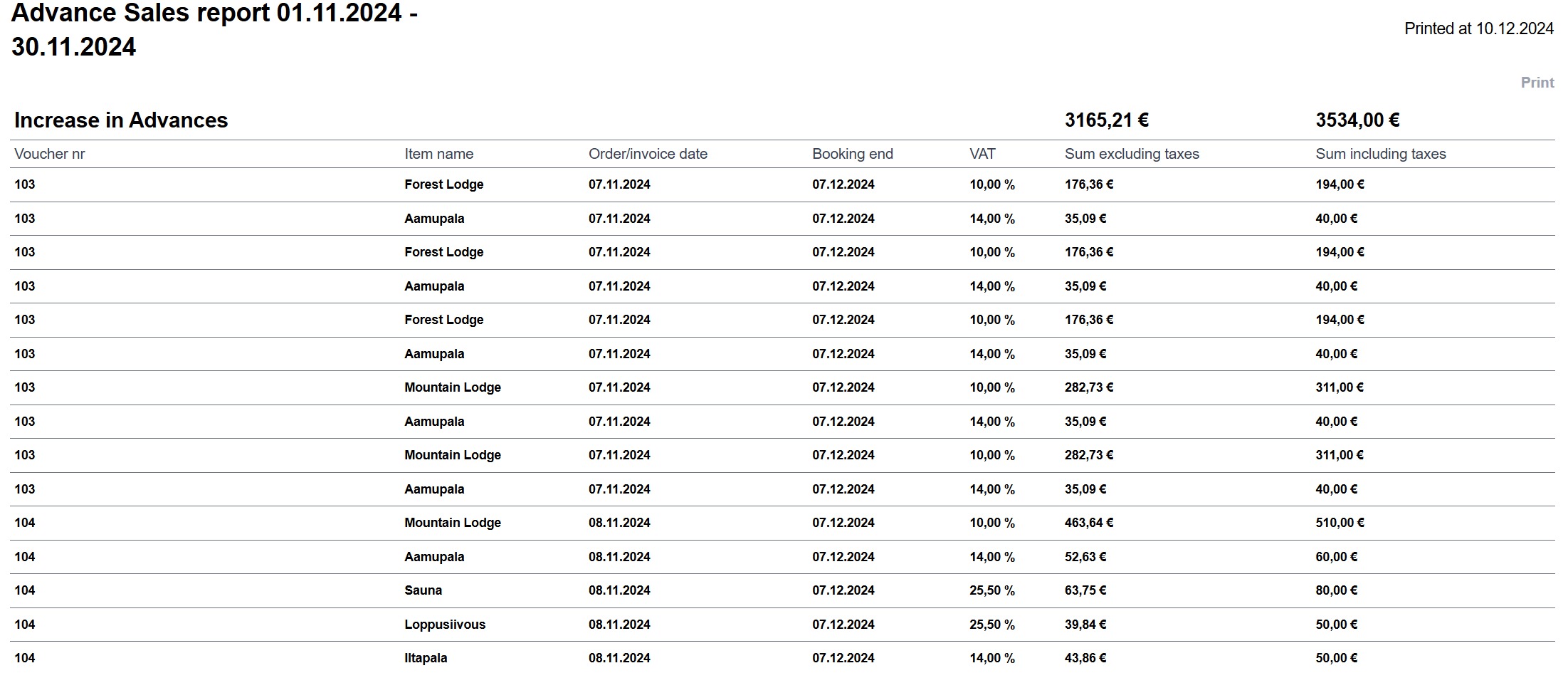

Deposits report

Deposits report provides an overview of open advance payments and invoices on the Moder platform for a selected time period. The report categorizes advances into additions and deductions and includes information about invoices and advance payments related to future bookings.

Key details of the report

- Increase in advances:

- This section lists all new invoices or advance payments made during the selected period.

- It includes both webshop bookings paid online and manually created invoices in Moder.

- The payment status of the invoice is irrelevant, so both paid and unpaid invoices related to future bookings are shown here.

- Decrease in advances:

- This section contains all invoices and advance payments associated with bookings that ended by the selected report date.

- Once a booking concludes, the related advance payment or invoice is recorded as sales and removed from the advances category.

- Open advances:

- This section records all advances added on the selected date, as well as other open advance payments or invoices tied to future bookings.

- The report does not account for the payment status of the invoices, including all future booking-related invoices, whether paid or unpaid.

Purpose of the report

- The report helps monitor advance payments and invoices related to future bookings and manage the company's advance sales.

- It provides a clear view of the status of advance payments and supports the accounting management of advances and sales.

Note that the report does not distinguish whether a booking is paid or unpaid. This is a key difference compared to the Deposit ledger report.

This report is an essential tool for businesses aiming to track advance sales and ensure all payments related to future bookings are up to date and well-managed.

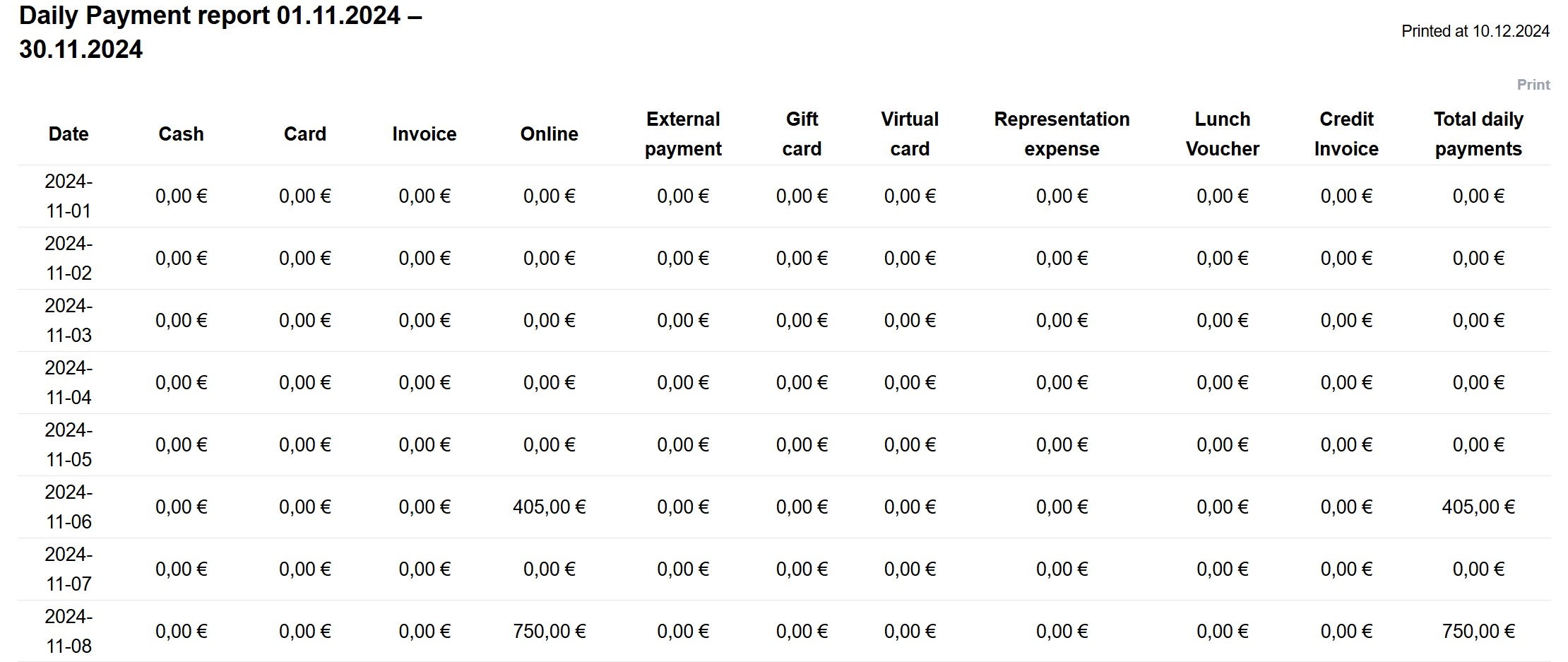

Daily payments report

Daily payment report provides a detailed breakdown of daily payment transactions by payment method. The report shows how much was recorded for each payment method on a given day, including card payments, gift cards, cash payments, and online payments (via Stripe).

Key details of the report

- Daily payment method breakdown:

- The report displays how much was recorded for each payment method on a specific day, such as card payments, gift cards, cash payments, etc.

- Online payments are logged on the payment date for payments received through Stripe.

- Total payment amounts:

- The report also provides the total amount across all payment methods per day, making it easier to monitor and report on daily cash flow.

Purpose of the report

- The report is useful for tracking daily payment transactions and managing finances.

- It provides a clear view of the payment methods used and the total payments received each day, supporting cash flow management and financial analysis.

This report is an essential tool for businesses aiming to monitor and manage daily payment transactions accurately by payment method, offering a clear overview of cash flow and payment trends.

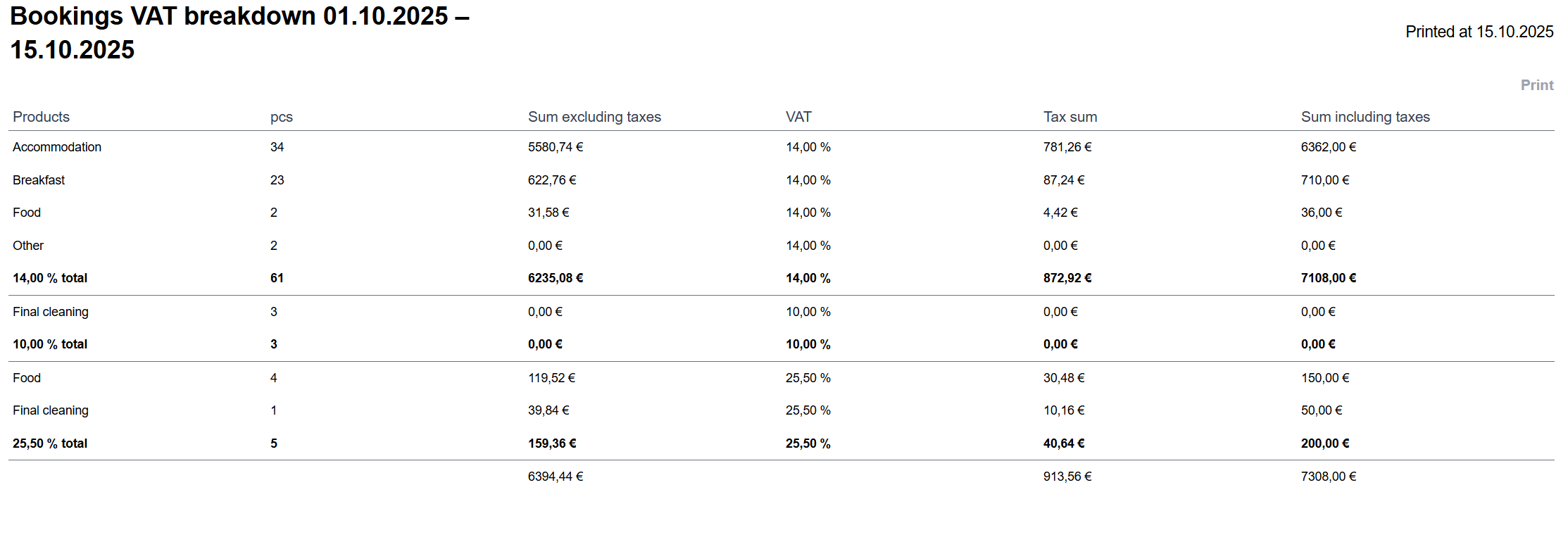

Bookings VAT breakdown

Bookings VAT breakdown report is designed to display all bookings received in Moder within a selected time period. The report categorizes products and services by different VAT rates, making it a valuable tool for tax management and sales tracking.

Key details of the report

- Booking time allocation:

- Includes all bookings made during the selected period, regardless of whether they have been paid or not.

- VAT classification breakdown:

- The report conveniently categorizes products and services based on different VAT rates, simplifying tax and accounting management.

- Inclusion of activities:

- To include activities in the report, ensure they are selected when generating the report so they appear in the results.

This report is particularly useful for tracking the distribution of taxes in sales and ensuring all products and services are appropriately reported according to their VAT classifications. It allows you to easily view sales associated with different VAT rates and use the data for more precise financial management and tax reporting.

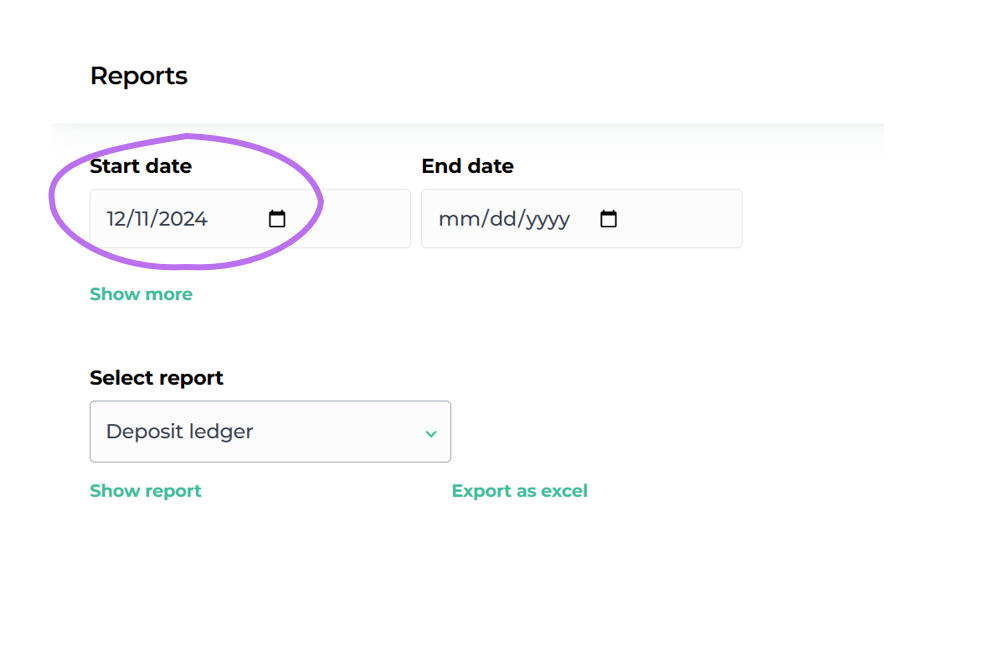

Deposit ledger

The Deposit ledger report compiles prepaid reservations (including invoices or online payments) from today onwards.

Exporting the report from Moder is exceptionally easy, as you only need to select one date - the current date in the "Date from" column.

Key details of the report

- Prepaid reservations from today onwards

- Includes all prepaid reservations listed on separate rows

- To appear on this report, a reservation must have an invoice or an online payment

- The report is generated in Moder by selecting just one date

- A prepaid reservation is removed from the report when the reservation occurs or the guest checks in

- A prepaid amount is removed from the report when the reservation is canceled

The Deposit ledger report is the best tool for reviewing prepaid amounts in the accounting process of an accommodation business. It provides a clear and accurate overview of all received advance payments that have not yet been recorded as actual sales revenue.

Brokerage sales report

The primary purpose of the Brokerage sales report is to provide a clear overview of how sales revenue and commissions are distributed between the service provider and the owner. This report is a crucial tool for settlements, even for those who do not sell their travel products through OTA channels (such as Booking.com or Airbnb). It helps manage commissions and earnings from both the owner's and the service provider's perspectives, offering a detailed view of how revenue is divided between different parties.

If external sales channels are used in addition to the webshop, the commissions from these channels must be accounted for in the Brokerage Sales Report. The report automatically includes all fees from external channels, ensuring that the amounts settled match the actual sales.

Key functions of the Brokerage Sales Report

1. Track commissions and fees

The report automatically calculates service provider commissions and sales channel fees for each reservation, whether they originate from external channels or directly from the webshop. This simplifies settlements and ensures that all parties receive a fair share of the sales.

2. Breakdown of revenue shares

The report provides a detailed breakdown of the intermediary’s share, sales channel fees, and the final amount retained by the owner. This helps owners and service providers evaluate the profitability of each channel and optimize their booking strategies.

3. Tax-inclusive and tax-exclusive amounts

The report accounts for the applicable tax rates, separating the amounts into taxable and non-taxable sums. This ensures owners have a precise understanding of the net income from each booking after taxes and fees are deducted.

Statistics and KPI reports

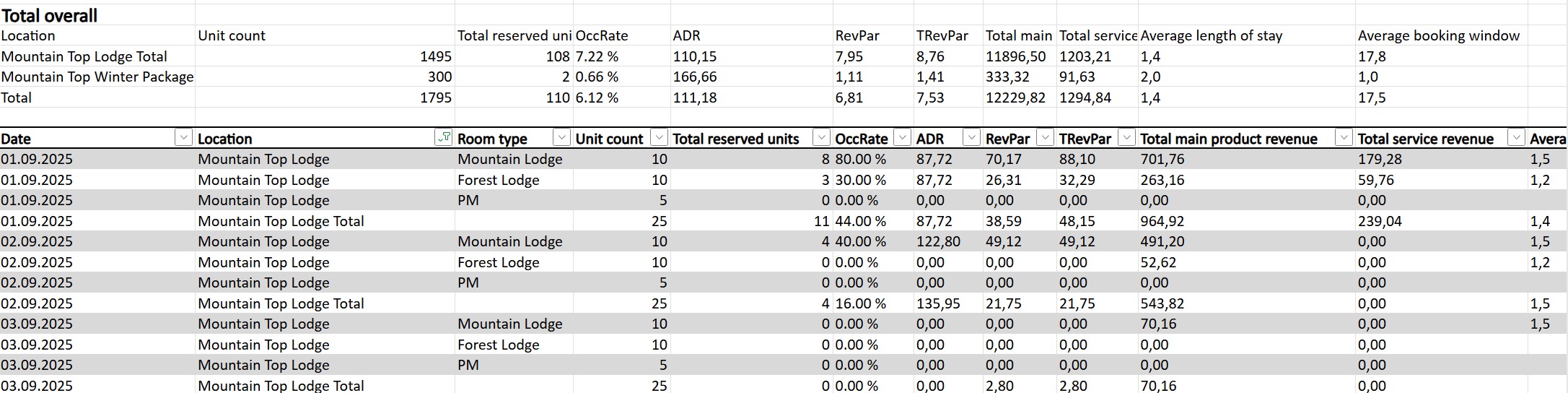

KPI dashboard - booking based

The KPI dashboard - booking based report is designed to provide accommodation businesses with key metrics for analyzing performance and comparing different time periods. It includes the most important figures for effectively evaluating operational efficiency and profitability.

Key details of the report

- Occupancy rate (OccRate): Displays the occupancy rate by room type, indicating how full the accommodation has been during the selected time period.

- Average daily rate (ADR): Shows the average selling price per room type, helping to monitor the effectiveness of pricing strategies.

- Revenue per available room (RevPAR): Indicates the average revenue per available room by room type, a crucial metric for assessing the productivity of the accommodation.

- Monthly accommodation revenue (Total accommodation revenue): Presents the total accommodation revenue for the selected period, with figures shown as tax-exclusive.

- Average booking window: Displays how far in advance guests typically book their stay. This metric helps with planning pricing strategies and targeted marketing efforts.

The report provides valuable insights into the performance of your accommodation, supporting data-driven decision-making. By tracking these metrics, you can monitor profitability, optimize strategies, and improve results over time.

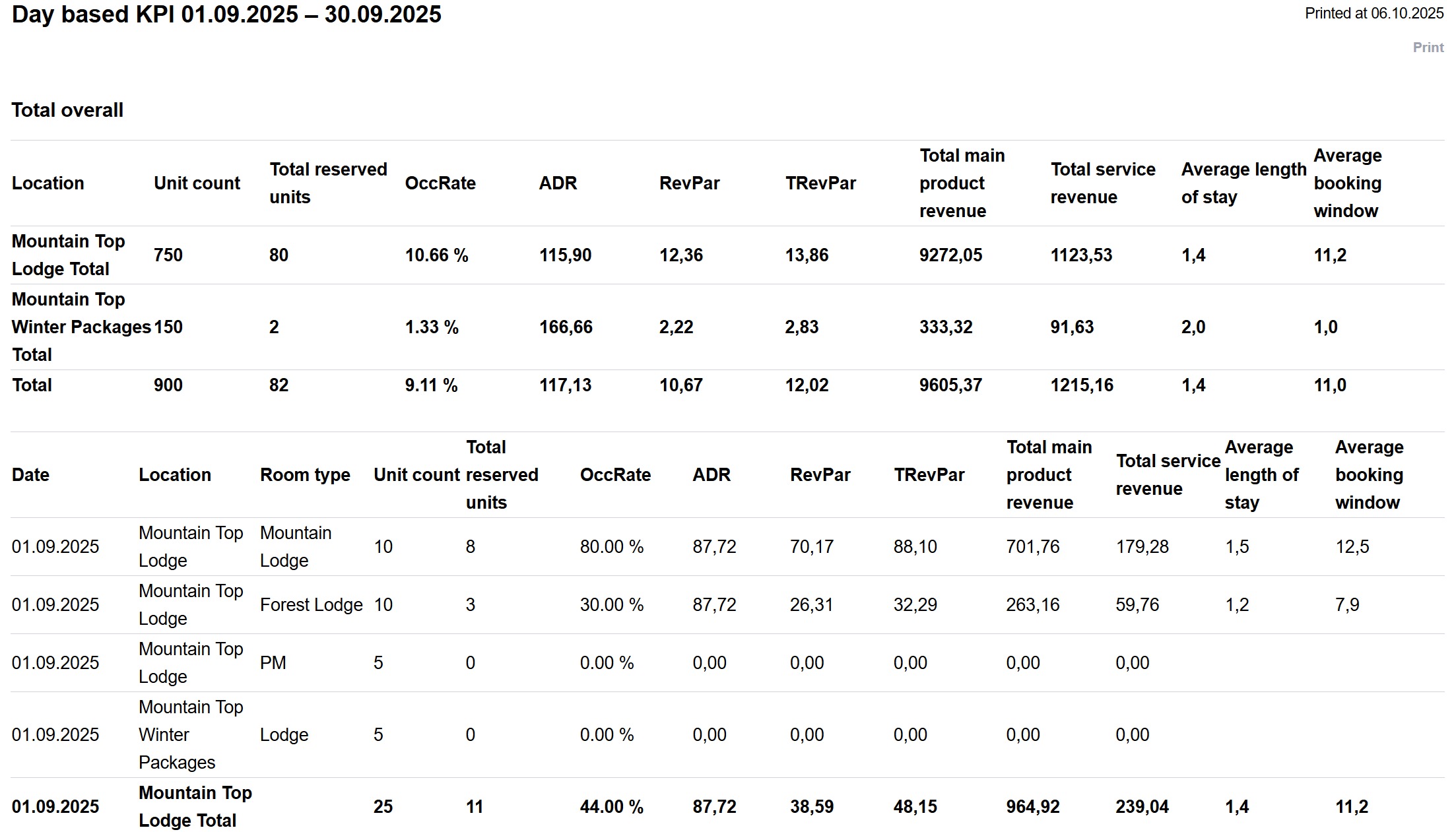

KPI dashboard - day based

The new daily KPI report (Key Performance Indicator report) gives you access to the most important hospitality industry metrics, helping you monitor your company’s performance accurately and in real time:

Occupancy rate – shows how much of your accommodation capacity is booked during a given period

ADR (Average Daily Rate) – the average room rate per sold room

RevPaR (Revenue per Available Room) – revenue per available room; combines occupancy rate and ADR

TRevPaR (Total Revenue per Available Room) – total revenue per available room, including extra services

Total main product revenue – total revenue from accommodation sales, excluding extra services.

In addition, the report includes complementary KPIs that help you better understand customer behavior and revenue structure:

Total service revenue – shows how much income comes from extra services that are booked together with the accommodation

Average length of stay – indicates the average number of nights guests stay

Average booking window – shows how many days before arrival bookings are made on average

How to get the most out of the new KPI report

To make the most of the daily KPI report, export it to Excel, convert the data into a table, and use filters. This allows you to flexibly view data across different time periods, compare results, and identify trends that support smarter business decisions.

We’ll demonstrate how to edit the Excel file and use filters in in this short video– showing you just how easily you can uncover insights that matter most for your business.

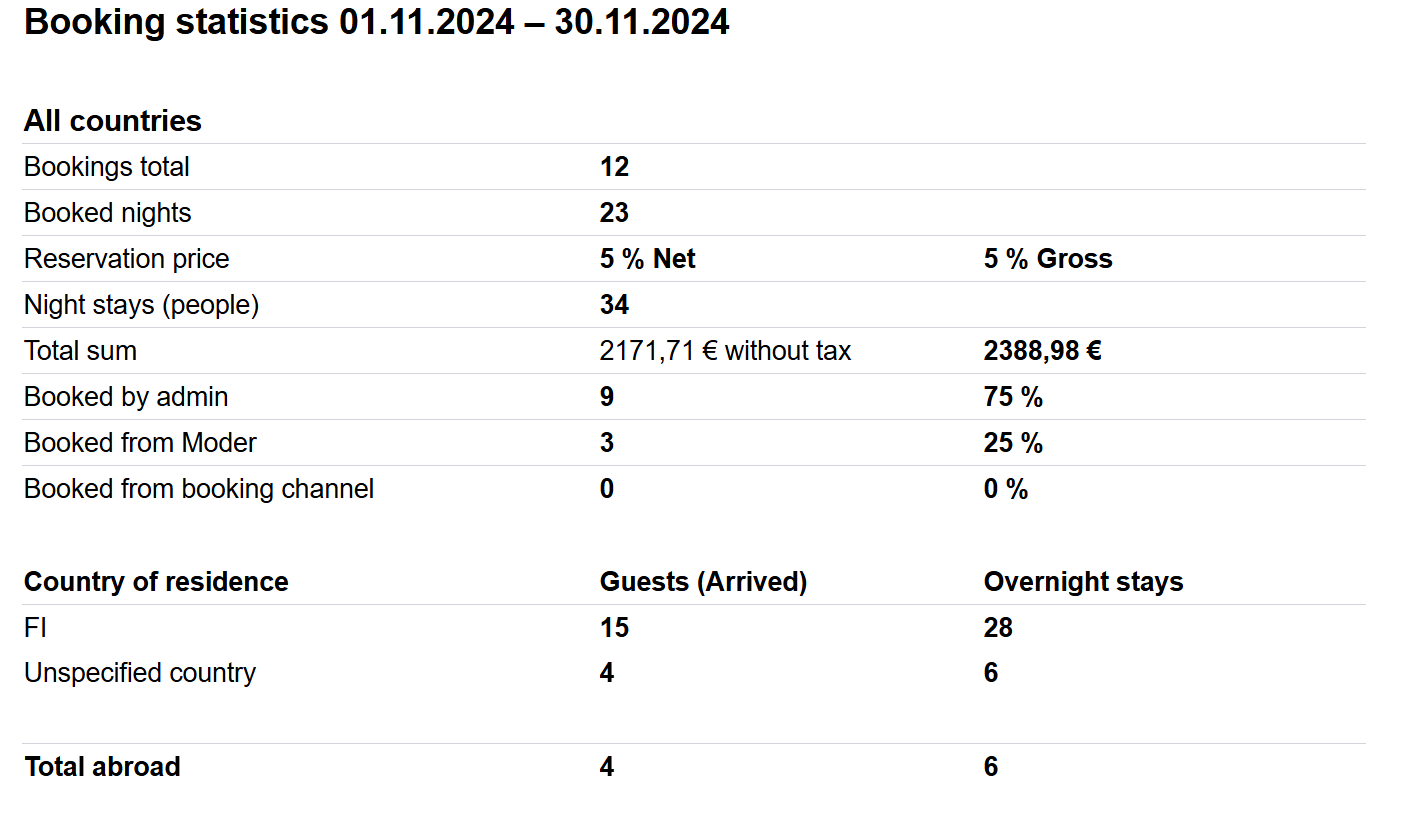

Statistics report

This report compiles various statistical data from a selected time period, making it a valuable tool for analyzing and reporting statistics.

Key details of the report

- Statistics on foreign guests: The report provides data, such as the number of overnight stays by foreign guests during the selected time period. This is particularly useful if you need to report monthly foreign guest statistics to Statistics Finland. Note that the data is accurate only if the guest’s country has been correctly entered for each reservation.

Moder does not yet offer direct integration with Statistics Finland, so figures must be manually retrieved from this report and entered on Statistics Finland’s website. - Reservation sources: The report shows how many bookings originated from different sales channels, such as external booking platforms ("Booked via external booking channel") and your webshop ("Booked via booking page").

This report is a useful tool for analyzing sales and accommodation booking statistics, particularly for breaking down bookings by source and reporting them to authorities like Statistics Finland.

Bookings export report

This report serves as a versatile tool for customer record management and marketing support. It compiles all bookings created within a selected time frame. For example, if you select the period from September 1–15, 2023, the report will include all bookings created during that time. Additionally, it includes information on whether the customer has consented to marketing during the booking process.

Key details of the report

Booking information:

- Booking duration: Start and end dates of the reservation.

- Booking number: Unique identifier for each booking.

- Booking source: Source of the booking, e.g., Booking.com or another platform.

- Discount code: Displays any discount code applied to the booking.

- Customer information:

- Name: Customer’s name.

- Address: Customer’s address.

- Email address: Contact information for marketing and communication.

- Accommodation details:

- Accommodation and unit: Specific details about the booked accommodation.

- Additional information: Notes or other details added to the booking.

- Booking language: The language used during the booking process.

- Payment details:

- Accommodation charges: Booking amounts shown both with and without taxes.

- Amount paid: Indicates how much the customer has already paid.

- Additional services: Reports on any extra services included in the booking.

- Marketing permissions:

- Marketing consent: Indicates whether the customer has agreed to receive marketing communications.

This report is a valuable tool for managing customer information, tracking bookings, and planning marketing activities. It provides a clear overview of customer details and booking specifics, enabling effective targeting of marketing campaigns and improved customer relationship management.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article